When you hire a listing agent, the job is not just to “get it sold.” The job is to protect your price and net you the most money possible.

One of the clearest stats that shows whether that is happening is Sold-to-List Ratio.

What is Sold-to-List Ratio?

It is the percentage of your asking price your home actually sells for. It is the “batting average” of an agent. Agents with a high list to sale ratio are the Babe Ruth of Real Estate. Here’s easy math:

-

List at $500,000 and sell at $475,000 = 95%

-

List at $500,000 and sell at $489,000 = 97.8%

That difference adds up fast.

2025 Market Baseline (Normal Agents)

In 2025, the “normal agent” performance across our market (residential sold, excluding our team) was:

-

Average Sold-to-List: 95.46%

-

Median Sold-to-List: 96.33%

-

Based on 749 sold listings

2025 Poltrock Team Results

2025 Poltrock Team Results

In 2025, our results (residential sold listings) were:

-

Average Sold-to-List: 97.74%

-

Median Sold-to-List: 98.34%

-

Based on 137 homes we sold.

The Difference That Matters:What Sellers Keep With Us

Average difference: 97.74% vs 95.46% = 2.28% higher

On a $500,000 home, 2.28% is about $11,400 more in your pocket.

Median difference: 98.34% vs 96.33% = 2.01% higher

On a $500,000 home, 2.01% is about $10,050 more.

Those are not small numbers. That is real money that most sellers never get back once it is negotiated away.

Why a Higher Sold-to-List Ratio Usually Means Better Representation

This stat typically comes from four things done consistently:

-

Strategic pricing that creates urgency (not stagnation).

-

Marketing that drives competition, not just “exposure.”

-

Negotiation that defends value on price, repairs, and concessions.

-

Clean systems and follow-through that keep buyers committed and deals together.

Bottom Line

If you want a team that consistently sells closer to list price than the average agent, you should start here.

If you are thinking about selling, call or message us and we will show you:

-

what your home is likely to sell for

-

how we recommend to position it in the market

-

what we do differently to protect your price

Ready to talk? Call 828-837-6400 or send us your information to our Contact Us page and we will reach out.. We’ll help you build a plan and deliver The Poltrock Team Difference.

n

n

The Cherohala Skyway, one of the most stunning scenic drives in the U.S., has just been awarded Hagerty’s 2025 Road of the Year. Known for its winding curves, breathtaking mountain views, and peaceful drive, the Skyway connects Robbinsville, North Carolina, to Tellico Plains, Tennessee—and it’s less than an hour from our office at

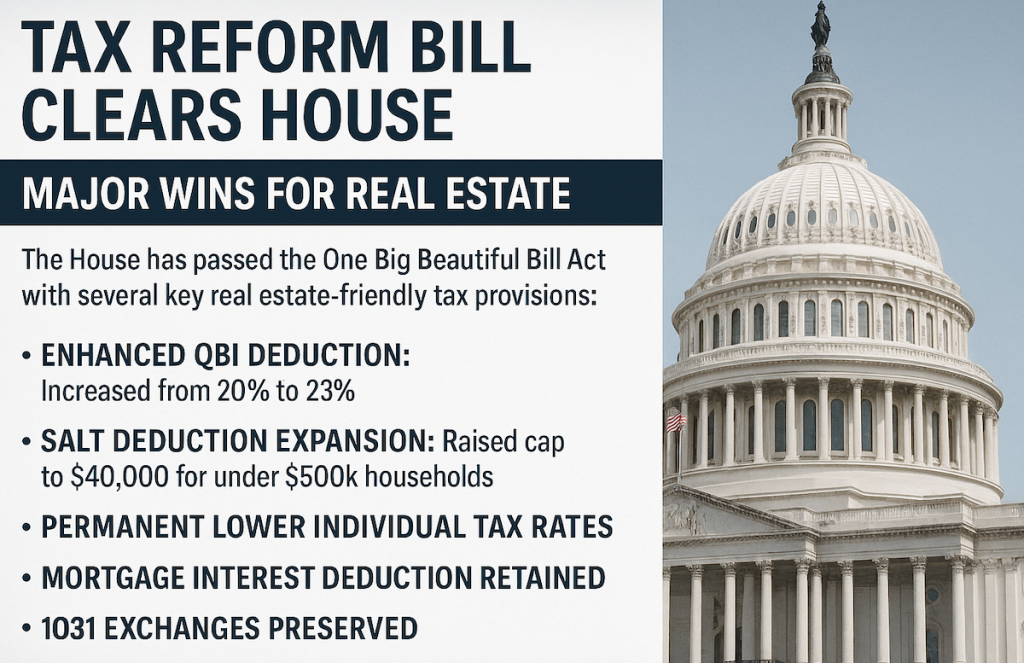

The Cherohala Skyway, one of the most stunning scenic drives in the U.S., has just been awarded Hagerty’s 2025 Road of the Year. Known for its winding curves, breathtaking mountain views, and peaceful drive, the Skyway connects Robbinsville, North Carolina, to Tellico Plains, Tennessee—and it’s less than an hour from our office at  The House of Representatives early this morning passed the One Big Beautiful Bill Act that delivers significant wins for the real estate sector, reinforcing tax provisions long championed by the National Association of REALTORS®.

The House of Representatives early this morning passed the One Big Beautiful Bill Act that delivers significant wins for the real estate sector, reinforcing tax provisions long championed by the National Association of REALTORS®.