I recently had a home builder ask me yesterday, “how do people usually pay for their homes when they’re buying?” I rattled off some approximates and quickly though, “I’ll get you exacts.” So I dove into the research and it was pretty fascinating to see how money is obtained in our real estate market.

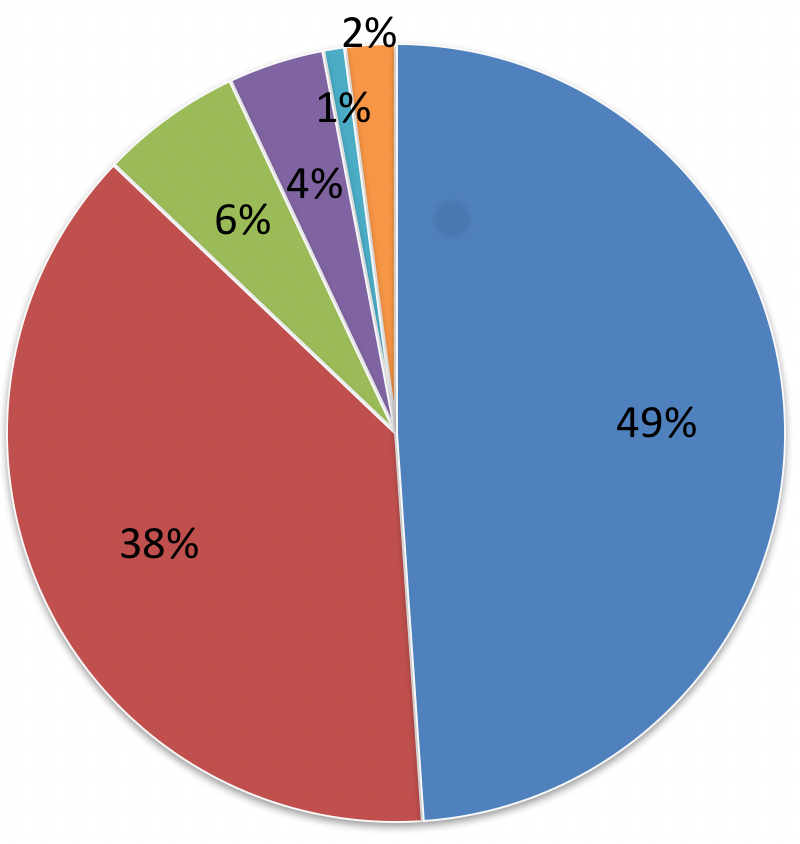

From January 1, 2024 through May 20, 2025, a total of 749 residential homes were sold in our local real estate market. Here’s the breakdown in how buyers are paying for their homes:

- Conventional Loans: 366 sales (49%)

Conventional financing remains the most popular method. Nearly half of all buyers secured a traditional mortgage loan—typically requiring good credit and a solid down payment. Sellers should be prepared for home inspections and appraisals, which are standard with this type of financing. - Cash Purchases: 286 sales (38%)

The mountains of North Carolina continue to attract cash buyers—often retirees, investors, or second-home purchasers. Cash deals represented 38% of all home sales, offering quick closings and fewer contingencies. Home inspections are quite common with most cash buyers, yet few require appraisals. - VA Loans: 44 sales (6%)

With 6% of home purchases backed by VA loans, we see strong demand from veterans. VA financing offers great benefits for qualified buyers, including zero down payment and no private mortgage insurance. While the appraisal process is bit more stringent with a few more requirements, for most properties, this is not a concern. Home inspections are very common for buyers to obtain, but that is not a VA requirement. - FHA Loans: 30 sales (4%)

FHA financing accounted for only 4% of purchases—ideal for first-time buyers or those with smaller down payments. Homes purchased with FHA loans must meet specific property standards, so sellers should ensure their home is in good condition and ready for inspection. - Seller Financing: 7 sales (1%)

Seller financing remains rare, used in just 1% of home sales. However, this method can open doors for buyers with unique financial situations or when traditional loans are not an option.

What does this mean when you’re selling your home?

If you’re listing your home, it’s important to work with a real estate team that understands the financing landscape. With over a third of buyers paying cash, and nearly half using conventional loans, knowing how to market your property effectively to both groups is key. Cash buyers may want a faster closing and fewer repairs, while financed buyers will need time for underwriting and inspections.

With over half of all closings being financed in some format, it’s critical to have the knowledge of what lenders and institutions are good and those that are horrible. We keep a list of lenders that don’t perform so you don’t waste your time with a borrower who most likely can never close the deal.

Advice for Home Buyers in Western North Carolina

Understanding the most common types of financing helps you stay competitive. Whether you’re a cash buyer looking for a great mountain property or securing a loan, partnering with a local real estate expert ensures you’re ready to move quickly when the right home hits the market. Not only that, we know the ins and outs of how to structure your loan for specific situations and locations. That can make the difference to closing or not.

Thinking of buying or selling? The Poltrock Team at RE/MAX has deep experience navigating all types of real estate transactions in Murphy, NC and surrounding areas. Whether you’re paying cash, using VA or FHA financing, or selling your mountain home, we’re here to help you succeed.

📞 Call us today at 828-837-6400 or Contact Us on our Website to get started!

*This data represents Cherokee County, North Carolina as compiled from the Mountain Lakes Board of Realtors MLS system. It includes the areas of Murphy NC, Andrews NC, Marble NC, Brasstown NC, and other sub communities.