The Cherohala Skyway, one of the most stunning scenic drives in the U.S., has just been awarded Hagerty’s 2025 Road of the Year. Known for its winding curves, breathtaking mountain views, and peaceful drive, the Skyway connects Robbinsville, North Carolina, to Tellico Plains, Tennessee—and it’s less than an hour from our office at The Poltrock Team – REMAX Mountain Properties in Murphy, NC.

The Cherohala Skyway, one of the most stunning scenic drives in the U.S., has just been awarded Hagerty’s 2025 Road of the Year. Known for its winding curves, breathtaking mountain views, and peaceful drive, the Skyway connects Robbinsville, North Carolina, to Tellico Plains, Tennessee—and it’s less than an hour from our office at The Poltrock Team – REMAX Mountain Properties in Murphy, NC.

Explore One of America’s Top Scenic Roads

Running 43 miles through the Cherokee and Nantahala National Forests, the Cherohala Skyway reaches elevations over 5,400 feet. With panoramic views of the Appalachian Mountains, smooth pavement, and very little traffic, it’s a favorite for car enthusiasts, motorcyclists, and anyone craving a quiet escape into nature.

Unlike the adrenaline-packed Tail of the Dragon nearby, the Skyway offers a more relaxed, scenic experience that’s perfect for fall foliage tours, photography, and peaceful weekend drives.

Only 50 Minutes from Murphy, NC

From our office located at 1900 US-64 W, Murphy, NC, you can be at the start of the Cherohala Skyway in under an hour. Whether you’re a visitor or a local resident, this national treasure is practically in your backyard!

Our clients love the fact that when they buy a home in Murphy or the surrounding areas, they’re gaining access to natural wonders like the Cherohala Skyway, Lake Hiwassee, and the Nantahala River. There are so many gems and things to do that are close to us, and this is one of many!

National Recognition, Local Living

This award from Hagerty—a trusted authority in automotive lifestyle and culture—highlights what we’ve always known: Western North Carolina is a spectacular place to live. From investment cabins and retirement homes to vacation getaways, owning real estate near iconic attractions like the Skyway adds lasting value and lifestyle perks.

Come See Why We Love It Here

Thinking about moving to the mountains? Want to tour property while you’re in the area enjoying the Skyway? Contact The Poltrock Team today—we’d love to help you find your home in the heart of North Carolina’s most scenic landscape. You’re also welcome to call us at 828-837-6400.

Then hop in the car, roll down the windows, and experience Hagerty’s Road of the Year for yourself—right here in our backyard. See their original article here: https://www.hagerty.com/media/driving/hagerty-road-of-the-year-2025-cherohala-skyway/

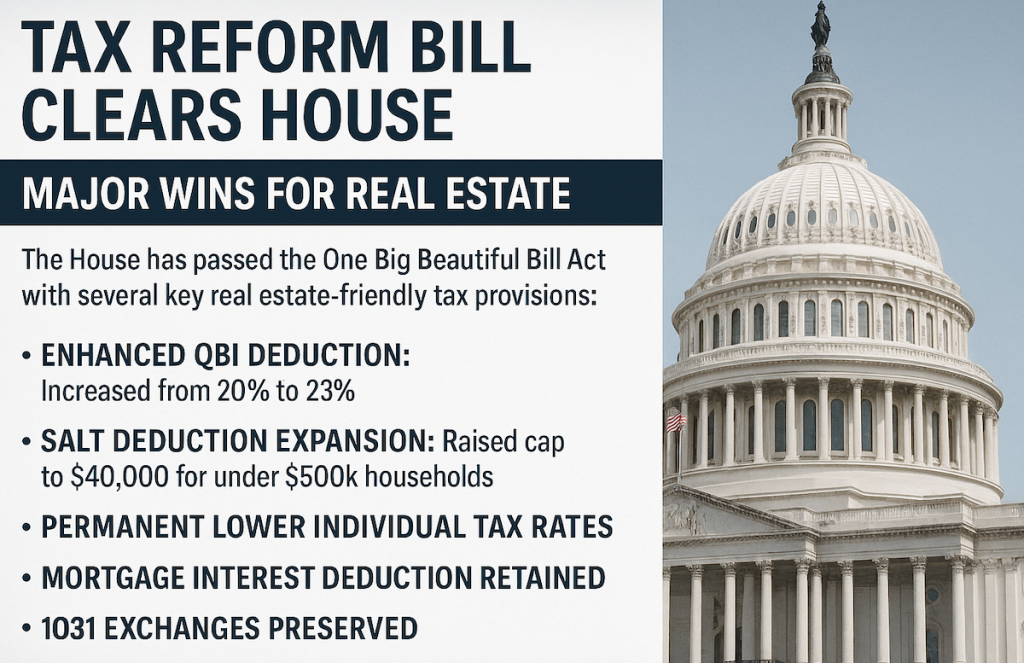

The House of Representatives early this morning passed the One Big Beautiful Bill Act that delivers significant wins for the real estate sector, reinforcing tax provisions long championed by the National Association of REALTORS®.

The House of Representatives early this morning passed the One Big Beautiful Bill Act that delivers significant wins for the real estate sector, reinforcing tax provisions long championed by the National Association of REALTORS®.